Luxembourg is known worldwide for its way of combining capitalistic liberalism with social projects that are unrivaled by other European countries. Luxembourg has numerous advantages for companies based here.

FAVOURABLE GROUND FOR BUSINESS

Communication with public authorities is easy and the relationships between economic and political players are tight. The legal framework in place acts in favour of companies.

FISCAL STRUCTURE

Luxembourg has implemented various legal mechanisms allowing it to be positioned as a top choice in Europe to set up companies in the holding business, commonly called “Sociétés de Participation Financières” (or SOPARFI – Financial Holding Companies). The applicability of European Union directives, fiscal exonerations, the unlimited deferment of losses and other forms of tax benefits provided by Luxembourg law, as well as the vast network of Luxembourg’s bilateral tax agreements make Luxemburg’s SOPARFIs an attractive model to benefit from a low effective tax rate, all in perfect harmony with European legislation.

STRONG COMPETITIVENESS

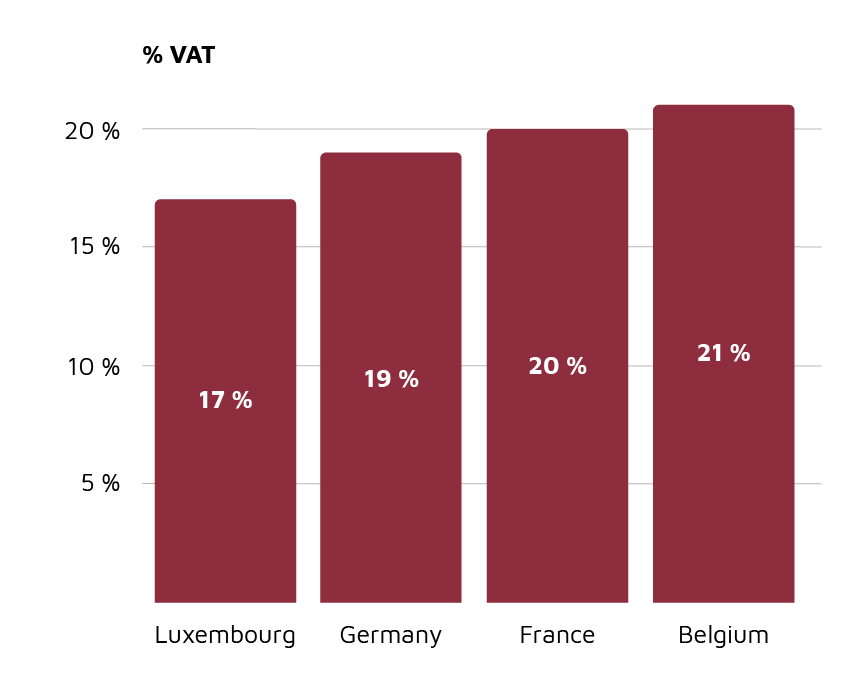

Luxembourg’s fiscal competitiveness is excellent, with VAT rate at Europe’s lowest: 17%.